Casino Etf Morningstar

It’s no secret anymore that gaming, or esports, is big business and that trend should continue in 2020. That said, investors should keep gaming-focused ETFs on their watch lists for the new year.

“Today, the gaming industry is not just about a time-killing fun thing, in fact, it is now a million-dollar worth industry,” a Business Matters article noted. “With mobile gambling apps and online video gaming platform, you can make thousands of dollars in no time. There are certain ways through which you can make money through this industry and live a life of fortune.”

Healthcare is huge. In 2017, healthcare spending in the U.S. Totaled $3.5 trillion - nearly 18% of the country's gross domestic product (GDP), which is the total market value of all products. That ETF has a lot of exposure to Microsoft and Apple. Combined, they make up about 35% of the exposure in the ETF. Brian, we can't talk ETFs and passive investing without talking about Vanguard, too. Morningstar assigns star ratings based on an analyst’s estimate of a stock's fair value. Four components drive the Star Rating: (1) our assessment of the firm’s economic moat, (2) our estimate of the stock’s fair value, (3) our uncertainty around that fair value estimate and (4) the current market price.

- Hyatt Hotels Corporation Class A is a company in the U.S. Stock market and it is a holding in 55 U.S.-traded ETFs. H has around 1.7M shares in the U.S.

- ETFs Bonds Best Investments. Morningstar Quantitative ratings for equities. Century Casinos Inc is a US-based international casino entertainment company. The company principally engages in.

The article went on to note that areas that will continue growing within the gaming sector include development, content creation, in-game sales, online coaching, and esports careers.

“Making money in the eSports industry is a highly obtainable goal, all you need to do is find the correct option you are passionate about and take the risk, the article added. “Without risk, no one can ever be successful therefore it is the time to do something and make a fortune from eSports.”

ETF investors willing to play the gaming sector in 2020 would be keen to check out these 4 funds:

- VanEck Vectors Video Gaming and eSports ETF (NasdaqGM: ESPO): With over $56 million in assets under management, ESPO is the biggest of the four. It seeks to replicate as closely as possible the price and yield performance of the MVIS® Global Video Gaming & eSports Index. The index is a global index that tracks the performance of the global video gaming and eSports (also known as electronic sports) segment.

- VanEck Vectors Gaming ETF (NasdaqGM: BJK): BJK is runner up in terms of size with over $27 million in assets. The fund seeks to replicate as closely as possible the price and yield performance of the MVIS® Global Gaming Index. For index eligibility, companies must generate at least 50% of their revenues from gaming. Gaming includes casinos and casino hotels, sports betting (including internet gambling and racetracks) and lottery services as well as gaming services, gaming technology and gaming equipment.

- Roundhill BITKRAFT Esports & Digital Entertainment ETF (NYSEArca: NERD): NERD doesn’t have the asset size of the first two funds, but it’s still worth a look given its current price of $15.74 as of Dec. 18. It seeks to track the total return performance of the Roundhill BITKRAFT Esports Index, which tracks the performance of the common stock of exchange-listed companies across the globe that earn revenue from electronic sports, or esports related business activities.

- Defiance NextGen Video Gaming ETF (NYSEArca: VIDG): VIDG is the smallest in terms of assets under management, but still worth a look. It seeks to track the total return performance of the BlueStar Next Gen Video Gaming Index, which consists of a modified market capitalization-weighted portfolio of the stock of companies whose products or services are predominantly tied to video gaming.

For more market trends, visit ETF Trends.

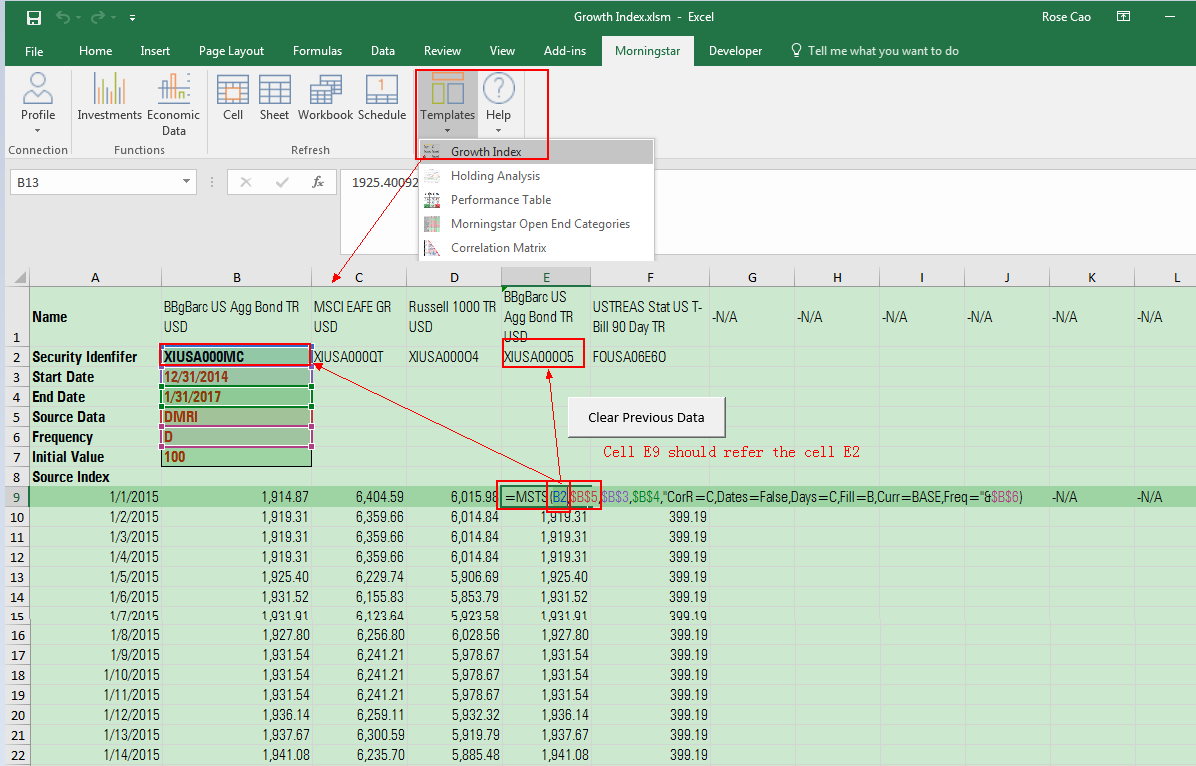

Morningstar’s Analysis The Morningstar Analysis section contains a thorough evaluation of an investment’s merits and drawbacks and often discusses the most important or decisive factors leading to the fund’s overall rating.

The Morningstar Analysis section contains a thorough evaluation of an investment’s merits and drawbacks and often discusses the most important or decisive factors leading to the fund’s overall rating.

Will BJK outperform in future?

Get our overall rating based on a fundamental assessment of the pillars below.

Casino Etf Morningstar

The Process Pillar is our assessment of how sensible, clearly defined, and repeatable BJK’s performance objective and investment process is for both security selection and portfolio construction.

The People Pillar is our evaluation of the BJK management team’s experience and ability. We find that high-quality management teams deliver superior performance relative to their benchmarks and/or peers.

The Parent Pillar is our rating of BJK’s parent organization’s priorities and whether they’re in line with investors’ interests.

Morningstar 5 Star Etf Funds

The number of funds that receive a Morningstar Analyst Rating is limited by the size of the Morningstar analyst team. To expand the number of funds we cover, we have developed a machine-learning model that uses the decision-making processes of our analysts, their past ratings decisions, and the data used to support those decisions. The machine-learning model is then applied to the “uncovered” fund universe to create the Morningstar Quantitative Rating (denoted on this page by a ), which is analogous to the rating a Morningstar analyst might assign to the fund if an analyst covered the fund. These quantitative rating predictions make up what we call the Morningstar Quantitative Rating™ for funds. Click here for more on how to use these ratings.

Unlock our full analysis with Morningstar Premium